Contents:

You can insert a new how to calculate pivot points to the chart by clicking Insert – Indicators – Custom. Once you have the value of X, calculating the pivot point is rather easy, as you just need to divide the value by four. For example, here is an hourly chart of the EUR/USD currency pair.

While the first three pivot points use the previous day’s high, low, and closing prices, only the DeMarks pivot points need the opening prices to calculate it. Pivot points, as the name suggests, are anchoring points drawn on a price chart to represent where the directional movement of a currency pair might turn back or continue. These are the areas of interest that the majority of floor trader watch on a daily basis to gauge the overall sentiment in the market. Pivot points are most commonly used by day traders, where some may use a one, three, five or even 15-minute or hourly chart. Our online trading platform offers chart timeframes under one-minute, such as one or five-second charts.

Pivot point candlesticks strategy

The best advice is to use your https://traderoom.info/ Point of choice with other technical analysis tools, including MACD, candlesticks and RSI. A move above the Pivot Point indicates strength and signals the trader to look at the first resistance as a target. With so many traders using both tools in their analysis, they can easily become self-fulfilling. A move below the Pivot Point suggests weakness with a target to the first support level. A break below the first support level shows even more weakness with a target to the second support level.

Pivot points are commonly combined with other technical indicators to make trading decisions. Pivot Points are significant support and resistance levels created with specific calculations. They were developed by professional traders on Wall Street to set the key levels.

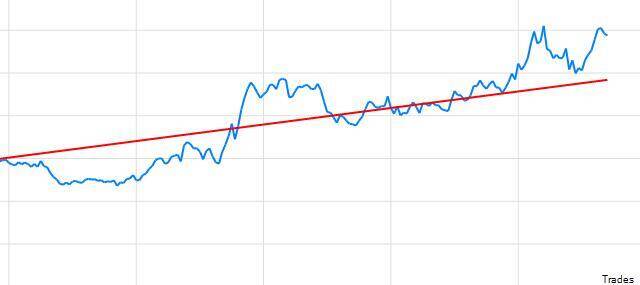

Pivot Points for 10-Minute S&P 500 Chart

These are calculated from the range of price movement in the previous trading period, added to the pivot point for resistances and subtracted from it for support levels. Support and resistance levels based on Pivot Points can be used just like traditional support and resistance levels. The key is to watch price action closely when these levels come into play. Should prices decline to support and then firm, traders can look for a successful test and bounce off support. It often helps to look for a bullish chart pattern or indicator signal to confirm an upturn from support.

After P is determined, calculate S1, S2, R1, and R2 using the highs and lows from Wednesday’s trading session. The average true range is a market volatility indicator used in technical analysis. The high and low in these calculations are from the prior trading day. Therefore, pivot points are important tools that many pros use to identify where the price will move to next.

An Ukrainian team is radically redesigning the submarine to fight the – Fast Company

An Ukrainian team is radically redesigning the submarine to fight the.

Posted: Thu, 13 Apr 2023 09:00:00 GMT [source]

The Non-Farm Payrolls news event drove USDJPY prices higher without hesitation, completely ignoring R1, where no resistance was exhibited. To conclude, the Pivot Points are helpful for traders in different ways. You can use them on their own or in combination with other indicators.

How to Identify Reversals and Retracements

The point is, regardless of which way the market would react, they often react around the pivot points. As these are areas of confluence, knowing where the pivot points are located on a chart can help you magnify your perception about the direction of the market and improve your win rate. Because entering the market after the price has broken out of major support or resistance would always help you ride the momentum better. We can interpret from the same chart that the engulfing patterns provided a few entries near S2. The first is a long, taken after a large up candle engulfs the prior down candle. The stop-loss is at the bottom of the small rectangle and it is quickly hit as the price continues to decline.

The pivot point calculator lets you select the formulae you want to use and remembers your choice when you come back. We can simply draw horizontal lines on a chart to represent the pivot points, including the three support and resistance levels. Treating these as potential support and resistance levels is one way to go about it.

A simple technical analysis of Dow Jones – ForexLive

A simple technical analysis of Dow Jones.

Posted: Tue, 27 Dec 2022 08:00:00 GMT [source]

Pivot point calculation techniques vary in terms of the weight assigned to each pivot point level, these are – pivot point, support and resistance, and the distance between each pivot point. In case of a breakout above R1, prices could potentially be driven towards R2, and the pivot point will serve as support and vice versa. If a breakout below the pivot point occurs, then prises can potentially drop further towards S1 and the pivot point will act as resistance. The concept states that, when prices float above the defined pivot point, the market is moving in a bullish direction and is likely to continue moving in an upwards direction, and vice versa. When the prices go below the pivot point, then the market is bearish and prices will probably move towards a downward direction. Keep in mind, pivot points are short-term indicators for the day of trading and need to be recalculated for the next day.

Learn Forex Trading

Cory is an expert on stock, forex and futures price action trading strategies. Determine significant support and resistance levels with the help of pivot points. Woodie’s pivot points are similar to floor pivot points, but are calculated in a somewhat different way, giving more weight to the Close price of the previous period.

On the other hand, the Standard version averages all three values, giving equal weight to all. By contrast, the DeMarks pivot points incorporate the opening price and the calculation might look more sophisticated as it takes the relationship between opening and closing prices. Please note that the Woodie’s pivot point only calculates two levels of support and resistances compared to the three levels found in the standard version.

A common question in technical analysis is, “what is a pivot point? ” Pivot points trading, or pivot point theory, is a popular technical analysis concept used in a range of financial asset classes, including stocks, currencies, and commodities. The indicator assists traders in gauging overall market trends and predicting possible support/resistance barriers during the current period.

You should then repeat these for the rest of the support and resistance levels. The standard pivot point is calculated in a simple way.First, you calculate the pivot point . You do this by adding the high, low, and close, and then divide the result by three. Traders use points to identify potential price levels where the market could reverse direction and determine potential price targets.

Determine significant daily, weekly, and monthly support and resistance levels with the help of pivot points. To learn more about how they work, check out our Pivot Points lesson. On the other hand, if the market opens or trades at extreme support or resistance levels, it has a general tendency to trade back to the pivot. However, despite being highly accurate in forecasting price movement, occasionally, the levels have little or no influence. So, as with all indicators, it is crucial to confirm pivot point signals with other aspects of technical analysis.

If the price moves past the first support or resistance, the market tends to expect that it will move to the second level. There are many ways of drawing the support and resistance levels. In this article, we will look at a guide on how to draw Pivot Points in Trading and use them in the market. If a reversal is confirmed, you can enter a trade in its direction .

Getting started with Bullish Candlesticks

Some sessions will see the price adhere to pivot points in an impressive way, while other days the price will simply disregard these levels. The simplest pivot points are called Standard or Classic pivot points. These are calculated based on the average of the high, low, and closing prices of a timeframe, which is often based on the previous day’s numbers. The five-minute gold chart below shows the price hovering around the pivot point early in the day. These downside breakouts could have been used to enter a short trade.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- As you begin, there is always an eternal debate among market participants on the close, open, high, and low prices because the forex market is usually open 24 hours every day.

- For example, here is an hourly chart of the EUR/USD currency pair.

- We can simply draw horizontal lines on a chart to represent the pivot points, including the three support and resistance levels.

- The R2 is calculated by PP + (High – Low) x0.618 and the R3 is calculated by PP + ((High – Low) x 1.000.

- But unlike Fibonacci levels, pivot points are not based on a percentage of a high and low point in a given timeframe.

Lines on the chart, which are calculated based on yesterday’s daily bar, go down to a smaller timeframe like the 60-minute or 5-minute chart for Intraday trading. The different calculation formulas for these four variants of pivot points prioritize different values. Thus, using one over another will give more or less weight to certain values. For example, the Woodie’s formula multiplies the closing price by 2, and as a result, the output figures put more weight on the closing price. Since closing price is the last value of a candlestick or bar, it emphasizes more on recent data than the high or low prices.

How to Use Pivot Point in Intraday Trading IIFL Knowledge Center – Indiainfoline

How to Use Pivot Point in Intraday Trading IIFL Knowledge Center.

Posted: Sat, 02 Apr 2022 14:08:54 GMT [source]

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. The most important is that these pivot points work for all traders and help in setting the right stop-loss and profit-target orders. The floor pivot points are the most basic and popular type of pivots. The pivot point is interpreted as the primary support/resistance level – the point at which the main trend is determined.

Among the four, only DeMarks pivot points use opening prices to measure the pivot levels. That’s why pivot points are such an important part of day trading as it can put your trading strategy on steroids in terms of finding direction and improving your money management. The Open price is only used in determination of the Demark’s Pivot Points. A timeframe of 15 minutes or less is typically required to carry out a candlestick strategy, as discussed above. Dropping down to a 10-minute chart below, more detail is visible in the price action.