Contents:

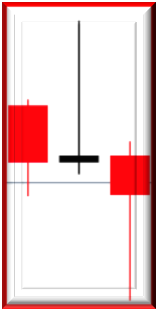

The larger the white and black candle, and the higher the white candle moves in relation to the black candle, the larger the potential reversal. A candlestick chart is popular amongst technical analysts when identifying a morning star forex pattern. The candlestick chart is used to predict or anticipate price action of a derivative, currency, or security over a short period. The pattern formed is known as the morning star pattern forex.

This pattern appears at the bottom of a downtrend and signals that the trend is reversing and heading upwards. Morning star patterns are generally seen as reasonably reliable indicators of market moves. They’re comparatively easy to spot, too, making them a useful early candlestick pattern for beginner technical traders. An evening star pattern is a bearish 3-bar reversal candlestick patternIt starts with a tall green candle, then a… The crucial thing to note in a morning star candlestick pattern is the middle candle can be white or black as the buyers and sellers begin to balance out over the session.

- After three sessions, you’ll either see it is performing, or it doesn’t occur at all.

- This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

- This, over time, is probably the best approach to study candlesticks.

- The only difference is that while the morning star is a bullish pattern, the evening star happens at the top of an asset.

Like being able to constantly monitor the stock price during the day, keeping your news channel on for any update news or any other livewire news online? I really want to know this because, I’ll tell you something about myself. After working for 6 years in corporate world I Ieft my job in 2014, since then I have been looking for a job but no luck. Now I’ve started to think about making trading as my full time career.

Morning Star Candlestick: Identification Guidelines

There is no such thing as the best time frame or the worst time frame. Your email address is stored securely and updates are pertinent to cryptocurrency trading. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. Hi Karthik, First comment is to thank you for helping all of us with this. I have read through all the candle sticks over and over agin, but your explanations are state of the art. My question is based on chart what Nitesh’s posted in above comment.

- The pattern formed is known as the morning star pattern forex.

- A morning star is best when it is backed up by volume and some other indicator like a support level.

- Notice that the open and close prices of candlestick two are almost equal, and the pattern ends more than halfway up the red stick that kicked it off?

- We’re also a community of traders that support each other on our daily trading journey.

- By understanding its characteristics, reliability, and the psychology behind its formation, traders can make more informed decisions.

The importance of the morning star happens when the fourth candle opens above the body of the star candle. The opposite occurring at the top of an uptrend is called an evening star. We used the volume indicator to help confirm the overall pattern and it played a crucial role in the easy-to-follow strategy that we proposed in this article. True, juggling a full time job and trading gets distracting.

What I’ve just shaevening star doji with you in this candlestick series training video is the ideal textbook pattern. If volume data is available, reliability is also enhanced if the volume on the first candlestick is below average and the volume on the third candlestick is above average. The third candle must be represented by a white candle that closes at least halfway up the first day’s black candle. The content on this website is provided for informational purposes only and isn’t intended to constitute professional financial advice. Trading any financial instrument involves a significant risk of loss. Commodity.com is not liable for any damages arising out of the use of its contents.

Get Started

Have a steady source of income like a salary and trade with capital that does not hurt your family needs. When you trade this way, the stress to make a fixed amount via trading is reduced, which means you can afford to be highly selective and trade only when you are thoroughly convinced. The stoploss for a long trade is the lowest low of the pattern. The stoploss for a short trade is the highest high of the pattern. As a rule of thumb, the higher the number of days involved in a pattern, the better it is to initiate the trade on the same day.

Stock Market Highlights: Nifty forms morning star pattern on weekly scale. What should traders do next week – Economic Times

Stock Market Highlights: Nifty forms morning star pattern on weekly scale. What should traders do next week.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

Morning and evening star forex patterns are very similar to each other. A bullish candlestick pattern known as the morning star forms when there is a downward trend. At the end of a downward trend, three candles are known to form. The morning star is a bullish candlestick pattern indicating a reversal in the current trend.

How to handle risk with the Morning Star pattern?

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Keep in mind all these informations are for educational purposes only and are NOT financial advice.

Examples include the price action that acts as support or the relative strength indicator that reveals excessive stock sales. A stop loss would typically be placed below the low of the small green candle, indicating a break in the downtrend. However, some traders may choose to place their stop loss below the low of the first red candle, as this will provide more room for the trade to move before being stopped out. The small candlestick that gaps below the black candle should close within the body of the black one. Finally, the white candlestick needs to close above the point where the black candle is exactly halfway through its body. The Morning Star is believed to be an indicator of potential market reversals and, therefore, can be used by traders to enter long positions.

Uniswap Price Analysis: Will UNI Skip Consolidation? – The Coin Republic

Uniswap Price Analysis: Will UNI Skip Consolidation?.

Posted: Sat, 18 Mar 2023 07:00:00 GMT [source]

The Morning Star pattern can be seen as an indication that the bearish trend is over and a bullish trend will begin. It’s important to wait for confirmation of this signal by looking for other signs of bullish sentiment and indicators such as moving averages, MACD, and RSI to confirm. If you arbitrarily sell 10 days after the breakout, you will find that the morning star after an upward breakout is the weakest performer. However, just letting the trend end when it ends instead of imposing a time limit shows that upward breakouts have better post-breakout performance than downward ones. That tells me the trend after the breakout from a morning star takes a while to get going but it tends to keep moving up. Patience is probably a good word for what you need when trading this candle pattern.

Psychological Behavior Behind the Pattern

But I do know people who manage this well….common trait across all these traders are that they place longer term trades. Something like a 1 week futures position or even equity position. I have got the essence of both your point and the candle stick pattern, so may be with time and experience I might be able to answer it. In the absence of P2’s doji/spinning top, it would have appeared as though P1 and P3 formed a bullish engulfing pattern. On day 2 of the pattern , the bears show dominance with a gap down opening. Now, the market ought to have reversed and started a new uptrend.

Price breaks out upward when it closes above the top of the candlestick pattern. A price upswing’s peak, where evening star patterns first appear, is bearish and indicates that the uptrend is about to end. The morning star forex pattern, seen as a bullish reversal candlestick pattern, is the opposite of the evening star pattern. Candlestick patterns are powerful tools used by traders and investors in technical analysis.

royalty free vector graphics and clipart matching Morning Star

And ride the uptrend until there are signs of another reversal. Third, the formation of the morning star during the third session is considered to be proof that the pattern is correct . Notice that the open and close prices of candlestick two are almost equal, and the pattern ends more than halfway up the red stick that kicked it off? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.17% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The fourth https://trading-market.org/ will then close at or above the high of the third candle. In an Evening Star pattern, the third candle will have a higher close than each of the first two candles. The fourth candle will then close below its low point on the third day and then close at or above its high point on day four. The technical storage or access that is used exclusively for anonymous statistical purposes.

Instead, they should be used in conjunction with other technical indicators to confirm the strength of the reversal signal. However, morning stars can also occur amid a downtrend, making them difficult to interpret. For this reason, many traders believe that morning stars are only effective when they are accompanied by volume and another sign, such as a support level. As said earlier, the occurrence of a morning star pattern is not as frequent as those of a single-candle formation.

The morning star candlestick pattern indicates that the bears have been selling aggressively and are exhausted. This causes buyers to step in and start buying, which lifts the prices of assets. While the Morning Star candlestick pattern is a reliable bullish reversal pattern, it is not foolproof.

What is needed is a knowledge of previous price action and where the pattern appears within the existing trend. Generally, a bullish candle on day 2 is seen as a stronger indicator that there’s and impending reversal. It starts with a bullish gap up, making it possible for bulls to push the price even further upward.

If there is a gap between the first and second candles , the odds of a reversal increase. The second candle must convey a state of indecision through either a Star candlestick or a Doji. Learn how to trade forex in a fun and easy-to-understand format.

My first goal is to earn an avg income of 1 thousand daily by investing and doing margin trading. Hence both the risk-averse and risk taker are advised to initiate the trade on P3. A morning star develops in a downward trend and marks the beginning of an upward rise. Traders look for the emergence of a morning star before using further indications to verify the occurrence of a reversal. The first is to wait and watch what happens in the session after the pattern.

The pattern is composed of three candles, with the first candle being bearish, followed by a small bullish candle, and then finally a large bullish candle. While the morning star candlestick pattern is a powerful tool, it is important to remember that no pattern is 100% accurate. Therefore, these should be used in conjunction with other technical indicators. Without these confirmations, they argue it is too risky to trade alone on a morning star pattern.

The third candle confirms the reversal and can mark a new uptrend. The morning star signifies that the money flow is reversing direction—from bearish to bullish. In other words, it means that investors are feeling more optimistic about the stock.

It forms at the bottom of a downtrend and indicates that the downtrend is about to reverse. A morning star candlestick pattern is reasonably easy to recognize. Most of the candlesticks will be red if you select the default setting on your trading platform. The Doji is one of the most widely recognized candlestick patterns and often signals a potential change in direction. The Morning Star and Evening Star patterns are also relatively easy to spot and can be quite useful in identifying trend reversals. The first is a long red stick – a clear sign that the bears still have momentum.

During the formation of the three candlesticks that make up this pattern, traders want to see volume increasing with the most volume present after the close of the third green candlestick. This acts as additional confirmation that price is getting ready for a reversal. We are beginning a new theme “Trading strategy’s most important technical analysis tools”.

The Harami pattern is a 2-bar reversal candlestick patternThe 2nd bar is contained within the 1st one Statistics to… We hope you’ve enjoyed this mini-course on candlesticks and their use in market analysis! If you have any questions at all about anything covered here or any other topics related to trading or investing, please feel free to comment below. One limitation of the Morning Star candlestick pattern is that it can take time to develop. Traders may miss the opportunity to enter a trade if they wait for the pattern to form completely. In this article, we’ll explore the characteristics of the morning star pattern, its reliability, the psychology behind its formation, and how you can analyze it using TradingView.